🌱 XUSF Key Performance Drivers

The performance of an ETF targeting U.S. large-cap financial stocks—especially with exposure to banks, insurers, and credit card companies—is influenced by a variety of macroeconomic, industry-specific, and company-level factors. Here are the most significant ones:

1. Interest Rates

- Banks typically benefit from rising interest rates because they can charge more for loans than they pay for deposits (net interest margin).

- Insurers may benefit as well, since they invest premiums in fixed-income securities that yield more in a higher-rate environment.

- Credit card companies can benefit from higher consumer borrowing but may face rising defaults if rates rise too quickly.

2. Economic Growth

- Strong GDP growth boosts consumer spending, business investment, and borrowing—benefiting all financials.

- Economic slowdowns or recessions typically lead to lower loan demand, higher default rates, and reduced asset values.

3. Credit and Default Risks

- Increased delinquencies or bankruptcies harm banks and credit card issuers.

- For insurers, large-scale catastrophic events or rising claim ratios can hurt profits.

4. Regulatory Environment

- Changes to banking regulations (e.g., Dodd-Frank Act modifications, capital requirements) can affect profitability.

- For insurers, state-level insurance regulations or national healthcare reform can be impactful.

- Credit card companies are subject to consumer protection laws, such as limits on interest rates and fees.

5. Inflation

- Moderate inflation may support interest rates and earnings.

- High inflation can lead to rate hikes, reducing borrowing and increasing operational costs.

6. Market Sentiment & Investor Confidence

- Financial stocks are sensitive to market cycles and investor risk appetite.

- During financial crises or downturns, these stocks often experience greater volatility.

7. Technological Disruption

- Fintech innovation or cybersecurity threats can impact traditional players’ market share and profitability.

8. Mergers & Acquisitions

- M&A activity can influence short-term performance and long-term growth prospects for ETF constituents.

9. Dividend Policies

- Many large-cap financials are dividend payers, so dividend trends (cuts or growth) can impact the ETF’s appeal.

🔍 XUSF Risk Assessment

As of May 2025, this ETF only has 2 years of history and $44M in assets, and is rated moderate-to-high risk by its issuer BlackRock. It can be used strategically to express a U.S. sector view, however may not be suitable for more risk-adverse investors and those with shorter investment horizons.

Before investing in a newly established ETF with a small amount of assets under management (AUM), be aware of key risks such as low liquidity, which can lead to wider bid-ask spreads and higher trading costs, and closure risk, as small ETFs (typically under $50M–$100M) may shut down if they don’t attract sufficient investor interest, potentially forcing investors to sell at an unfavorable time.

Additionally, such funds may lack a performance track record, have limited institutional backing, and may not efficiently track their underlying index or strategy due to smaller scale.

🧭 XUSF Trend Analysis

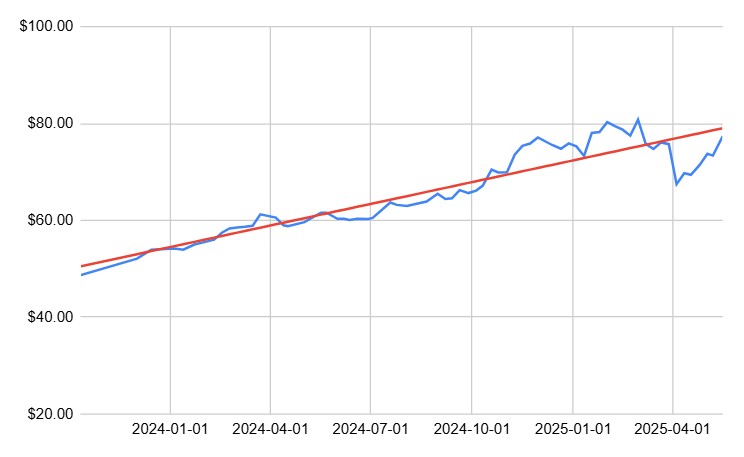

As of May 2025, a linear regression model on 2 years of XUSF timeseries data produces an r-squared of 0.88, indicating a strong upward growth trend in this ETF, with 88% of its price variations explained simply by the passage of time. Keep in mind however, that past performance does not necessarily guarantee future trends will continue the same way.

📈 Key Drivers of XUSF’s Growth Trend from Oct 2023 to Jan 2025

1. Robust Earnings and Profitability in the Banking Sector

Major U.S. banks reported strong earnings, with a 16% increase in profits during Q4 2024 compared to the previous year. This growth was fueled by heightened trading activity and increased dealmaking, leading to a total profit of $31 billion for the quarter. Financial Times

2. Resurgence in Mergers and Acquisitions (M&A)

After a period of subdued M&A activity, the financial sector witnessed a revival. Notable deals, such as Capital One’s acquisition of Discover Financial Services, signaled renewed confidence and strategic expansion within the industry. Barron’sMarketWatch

3. Strong Performance of Credit Card Companies

Leading credit card companies like Visa and Mastercard reached all-time highs, reflecting robust consumer spending and increased transaction volumes. Visa reported a 9% revenue increase to $9.59 billion, while Mastercard saw a 14% revenue growth to $7.49 billion. Investor’s Business Daily

4. Favorable Economic Conditions and Regulatory Environment

The U.S. economy demonstrated resilience, with GDP growth of approximately 3% in both 2023 and 2024. Additionally, expectations of a soft landing and potential deregulation under the Trump administration contributed to positive sentiment in the financial sector.

5. Investor Rotation into Financial Stocks

As technology stocks faced valuation concerns, investors rotated into financial stocks, viewing them as undervalued with strong fundamentals. This shift was supported by analysts who highlighted the potential for financials to become the new momentum stocks. Barron’s

📉 Key Drivers of XUSF’s Decline Trend from Feb-Apr 2025

1. Escalation of Trade Wars and Tariffs

In early 2025, the U.S. administration implemented substantial tariffs on imports from China, Canada, and Mexico. On April 2, dubbed “Liberation Day,” President Trump announced sweeping tariffs impacting nearly all sectors of the U.S. economy. This move triggered widespread panic selling across global stock markets, leading to the largest global market decline since the 2020 stock market crash. Wikipedia

2. Stock Market Turmoil

The announcement of new tariffs led to a sharp downturn in U.S. equities. On April 3, the S&P 500 lost 6.65% of its value, and the Dow Jones Industrial Average fell by 3.98%. The financial sector, being highly sensitive to economic cycles and policy changes, was particularly hard-hit during this period. Wikipedia

3. Investor Shift to Safer Assets

Amid fears of a recession and rising inflation, investors pulled significant funds from U.S. bond and equity markets. In the week ending April 9, U.S. bond funds experienced net outflows of $15.64 billion, the largest since December 2022. Sector-focused funds, particularly financials, also suffered, with the financial sector losing $2.05 billion—the worst since April 2022. Reuters

4. Yield Curve Inversion and Profit Margin Pressures

The combination of rising short-term interest rates and falling long-term Treasury rates led to a yield curve inversion. This scenario typically signals an impending recession and compresses banks’ net interest margins, thereby reducing profitability. Barron’s

5. Global Economic Uncertainty

The aggressive trade policies and resulting market volatility contributed to a broader sense of economic uncertainty. This environment led to decreased consumer confidence and spending, further impacting financial institutions reliant on consumer and business lending.

Disclaimer

The content provided on this blog is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed herein are those of the author(s) and do not reflect the views of any affiliated organizations or institutions.

All investment strategies and investments involve risk of loss. Nothing in this blog should be construed as a recommendation, solicitation, or offer to buy or sell any securities or other financial instruments. You are solely responsible for your investment decisions and should seek the advice of a qualified financial advisor or other professional before making any financial decisions.

The information on this site is provided “as is” without any representations or warranties, express or implied. The author(s) make no representations or warranties in relation to the accuracy, completeness, timeliness, or reliability of any information on this site or found by following any link on this site.

Past performance is not indicative of future results. The author(s) may hold positions in or have other financial interests in securities discussed on this blog.

By using this blog, you agree not to hold the author(s) liable for any losses, damages, or expenses that may arise from reliance on the information provided.