🌱 XST Key Performance Drivers

An exchange-traded fund (ETF) that targets Canadian consumer staples companies will have performance driven by a combination of macro, sector-specific, and company-level factors. Here are the key performance drivers:

1. Economic and Consumer Spending Trends in Canada

- Stable Consumer Demand: Consumer staples (groceries, household products, personal care) tend to be non-cyclical, but still rely on steady consumption.

- Inflation Impact: Moderate inflation can be passed on to consumers, supporting revenue. However, high input cost inflation may compress margins.

- Interest Rates & Monetary Policy: High interest rates may impact consumer disposable income and cost of capital for companies.

2. Company Fundamentals

- Revenue & Earnings Growth: Stability and predictability in cash flows are key, but companies with growth potential in adjacent sectors (e.g., e-commerce, private label) may outperform.

- Margins: Gross and operating margins are critical, especially in inflationary environments.

- Debt Levels: Many consumer staples firms carry debt; sensitivity to interest rate changes can be a performance differentiator.

3. Commodity & Input Costs

- Raw Materials (e.g., packaging, agricultural inputs): Cost fluctuations in materials like wheat, corn, oil, or packaging can impact profitability.

- Currency Fluctuations: Many Canadian companies import goods or materials; a weak CAD can raise costs.

4. Retail & Distribution Dynamics

- Supply Chain Efficiency: Disruptions (as seen in COVID) can hurt inventory management and profitability.

- Private Label vs. Branded Competition: Competitive pricing from retailers’ own brands can pressure margins of branded players.

5. Regulatory and ESG Factors

- Health & Safety Regulations: Changes in labeling, packaging, or ingredient rules can affect product portfolios.

- ESG Performance: Increasing investor and consumer focus on sustainability can boost or harm perception and valuation.

6. Market Concentration in ETF Holdings

Most Canadian consumer staples ETFs are heavily weighted toward a few large-cap companies, such as:

- Loblaw Companies Ltd.

- Metro Inc.

- George Weston Ltd.

- Alimentation Couche-Tard Inc.

Their performance significantly influences the ETF’s returns.

7. Dividend Yields

- Consumer staples companies often pay steady dividends; ETFs targeting them attract income-seeking investors.

- Yield changes due to payout adjustments or interest rate moves affect ETF valuation and investor demand.

8. Broader Market Sentiment

- In risk-off environments, defensive sectors like consumer staples often outperform.

- Conversely, in risk-on markets, staples may underperform growth sectors like tech or discretionary.

🔍 XST Risk Assessment

1. Concentration & Holdings Risk

- Limited number of holdings: XST tracks a capped consumer staples index, with around 10 stocks. The top 2 holdings represent ~50%, and the top 4 account for ~80% of its assets (reddit.com).

- Sector skew: These are primarily grocery retailers (e.g., Loblaw, Metro, Couche-Tard). As one Redditor pointed out: “Not only is it limited to just 10 holdings… the two largest account for 50%… the top four holdings make up 80%… all grocers.” (reddit.com)

This concentration heightens exposure to idiosyncratic risks such as competitive pressures, labor issues, or regulatory changes affecting grocers.

2. Volatility & Risk‑Return Profile

- Moderate volatility: Annualized standard deviation over 5 years is around 17.65% (valueray.com).

- Low beta: With a beta near 0.14, XST shows lower sensitivity to broader market moves (valueray.com).

- Sharpe ratio ~0.93, indicating decent risk-adjusted returns (valueray.com).

3. Fees & Cost Efficiency

- MER of ~0.61%, relatively high given the small number of holdings and moderate trading volumes (tradingview.com).

- Many Reddit users note that this fee is steep for a passively managed, lightly diversified ETF. Alternatives like broad Canadian index funds (e.g. XIC) have much lower MERs (~0.06%).

4. Liquidity & Trading Risk

- AUM between CAD 245–320 million, with average daily volume around 14,000–15,000 shares (reddit.com).

- This provides sufficient liquidity for retail investors, though bid-ask spreads may widen for larger trades.

5. Defensive Sector Nature

- Consumer staples are traditionally defensive assets, performing relatively well during economic slowdowns.

- Historically, XST has outperformed the broader TSX (XIC) in several periods—for instance, annualized ~13.8% since inception vs ~7.6% for XIC (investing.com, reddit.com).

- Still, in strong bull markets, it can lag (annualized XST +11 % vs XIC +25 % over the past year) (reddit.com).

6. Macro & Commodity Exposure

- Though Canadian-focused, staples companies still face currency exposure, input costs, and commodity price volatility (e.g., packaging, food ingredients).

- These factors can compress margins or impair performance if costs spike.

🧭 XST Trend Analysis

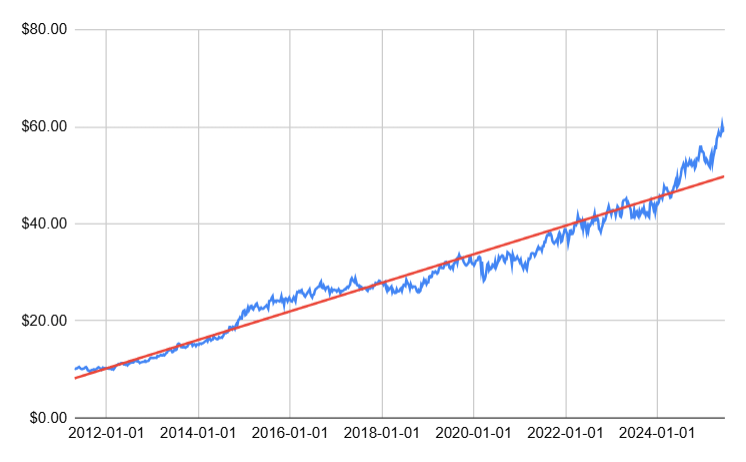

As of June 2025, a linear regression model on 14 years of XST timeseries data produces an r-squared of 0.96, indicating a strong upward growth trend in this ETF with 96% of its price variations explained simply by the passage of time. Keep in mind however, that past performance does not necessarily guarantee future trends will continue the same way.

📈 Key Drivers of XST’s Exceptional Growth Trend from Jan 2024 to June 2025

From January 2024 to today (June 2025), XST has experienced a strong upward trend—about 19–24 % YTD—driven by a combination of company-specific gains, macroeconomic tailwinds, and shifts in investor sentiment. Here’s a detailed breakdown:

1. Strong Performance of Major Staples Holdings

- Top holdings like Alimentation Couche‑Tard, Loblaw, Metro, Saputo, Empire dominate XST (~75 % combined) (reddit.com, wealthawesome.com).

- These companies delivered solid earnings in 2024–25, supported by stable consumer demand and pricing power.

- After the end of the federal GST rebate (holiday), grocers reportedly raised prices, improving both revenue and margins (reddit.com).

2. Defensive Appeal in Market Volatility

- XST’s consumer staples focus makes it a favored “defensive” play, especially in periods of broader market uncertainty.

- In Oct 2024, the Consumer Staples sector posted ~+18 % YTD on the TSX, largely mirroring XST’s rise (reddit.com).

- Its reputation for downside protection and steady dividends attracted more inflows from conservative investors (reddit.com).

3. Dividend Income & Yield Support

- XST offers a ~1.3 % dividend yield, with consistent quarterly payouts (e.g., 0.11–0.54 CAD per quarter in 2024) (marketlog.com).

- This stable income stream resonated with yield-seeking investors, especially amid uncertain rate environments.

4. Commodity & Currency Stability

- Input cost pressures (fuel, packaging, food) were relatively contained in 2024–25, helping margins remain intact.

- The CAD/USD exchange rate remained stable, reducing cost volatility for companies importing goods—boosting overall profitability .

5. TSX Consumer Staples Sector Leadership

- Within the TSX, the Consumer Staples sector outperformed, bolstering XST’s relative returns.

- While commodities and energy led TSX performance overall, staples still delivered strong double-digit gains, benefiting XST (reddit.com).

6. Index Rebalancing & Flows

- As the S&P/TSX Capped Consumer Staples Index appreciated—driven by rising share prices in its constituents—XST naturally gained through index tracking (blackrock.com).

- Increased investor interest and inflows from those seeking defensive exposure further lifted NAV per share.

Disclaimer

The content provided on this blog is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed herein are those of the author(s) and do not reflect the views of any affiliated organizations or institutions.

All investment strategies and investments involve risk of loss. Nothing in this blog should be construed as a recommendation, solicitation, or offer to buy or sell any securities or other financial instruments. You are solely responsible for your investment decisions and should seek the advice of a qualified financial advisor or other professional before making any financial decisions.

The information on this site is provided “as is” without any representations or warranties, express or implied. The author(s) make no representations or warranties in relation to the accuracy, completeness, timeliness, or reliability of any information on this site or found by following any link on this site.

Past performance is not indicative of future results. The author(s) may hold positions in or have other financial interests in securities discussed on this blog.

By using this blog, you agree not to hold the author(s) liable for any losses, damages, or expenses that may arise from reliance on the information provided.