🌱 XMW Key Performance Drivers

An ETF that tracks an index designed to capture equity securities from both emerging and developed markets with lower volatility than the MSCI ACWI (All Country World Index covering ~ 23 developed and 24 emerging markets) would have key performance drivers centered around both broad equity market factors and specific low-volatility strategy mechanics.

1. Global Equity Market Trends

- Overall equity market performance — both developed and emerging markets — will set the baseline.

- Since it includes a broad universe, factors like:

- Global GDP growth

- Interest rate policies (Fed, ECB, emerging markets)

- Currency fluctuations

- Geopolitical stability

- If global equities are rising, the ETF will likely perform positively but may lag slightly in strong bull markets.

2. Low-Volatility Factor Premium

- The ETF specifically targets stocks with historically lower volatility (price stability).

- Key driver: how much investors favor or disfavor defensive stocks like utilities, consumer staples, and healthcare.

- Historically, low-volatility stocks tend to:

- Outperform in down or sideways markets

- Underperform in strong bull markets

3. Sector Composition Bias

- These ETFs generally have:

- Overweight: Defensive sectors (utilities, healthcare, consumer staples)

- Underweight: Cyclicals and tech

- Sector rotation trends (e.g., growth vs. value) heavily influence relative performance.

- Example: If energy or tech rallies, the ETF may lag MSCI ACWI.

4. Geographic Exposure Mix

- Balance between developed and emerging markets within the index affects risk-return.

- If emerging markets are more volatile or underperform, the ETF’s lower EM exposure can help protect returns.

- Currency fluctuations (USD strength/weakness) also matter, especially for EM holdings.

5. Interest Rate Sensitivity

- Low-volatility stocks, particularly defensive dividend-payers, often behave like bond proxies.

- Rising interest rates tend to:

- Hurt utilities, real estate, staples (higher yield = less attractive dividends).

- Benefit financials.

- Falling rates can boost performance.

6. Volatility Regime & Market Sentiment

- The equity volatility environment itself directly impacts this type of ETF’s relative performance.

- Key point:

- During high-volatility periods (e.g., market sell-offs), these ETFs typically outperform broader indices.

- In calm, risk-on environments, they may lag.

7. Rebalancing & Methodology Effects

- Index rebalancing rules affect outcomes:

- How often the index updates its volatility screens (quarterly, semi-annual).

- Whether weighting is done purely by volatility, or combined with size/liquidity screens.

- Certain index providers (like MSCI or S&P) may incorporate different constraints on country or sector weights.

🔍 XMW Risk Assessment

As of July 2025, XMW has only $198M in Net Assets, which is relatively low and can lead to wider bid-ask spreads and higher trading costs. However the ETF has relatively long history of 13 years, hence closure risk is less likely.

Lower volatility ≠ risk-free.

- XMW tends to:

- Outperform in down or choppy markets.

- Lag during strong, risk-on rallies.

- Risks are generally more about opportunity cost and relative performance rather than outright capital loss, especially compared to more aggressive global equity ETFs.

✅ XMW Is Generally Suitable For:

- Risk-Averse Equity Investors:

Those who want global equity exposure but with reduced volatility compared to standard global indices. - Long-Term Core Holdings:

Investors looking for a defensive global equity allocation in retirement portfolios or balanced funds. - Market Uncertainty Mitigation:

Those seeking equity exposure while minimizing downside risk during volatile or bear markets. - Dividend-Income Seekers (Moderate Level):

Defensive sectors like utilities and consumer staples often provide stable, modest dividend yields. - Diversification Across Developed Markets:

Investors wanting broad global developed-market equity exposure without focusing on emerging markets or single-country risk.

❌ XMW May Not Be Suitable For:

- Aggressive Growth Investors:

Investors seeking high-growth potential from sectors like technology, emerging markets, or small caps may find XMW too conservative. - Investors Focused on Maximum Upside:

In strong bull markets, low-volatility strategies tend to underperform compared to traditional broad-market ETFs like MSCI World or S&P 500. - Short-Term Traders:

XMW is designed for longer-term, lower-churn portfolios. It’s not suited for tactical or high-frequency trading. - Investors Concerned About Sector Imbalance:

The ETF’s overweight to defensive sectors (utilities, staples) may lead to sector imbalances relative to a market-cap-weighted world index.

🧭 XMW Trend Analysis

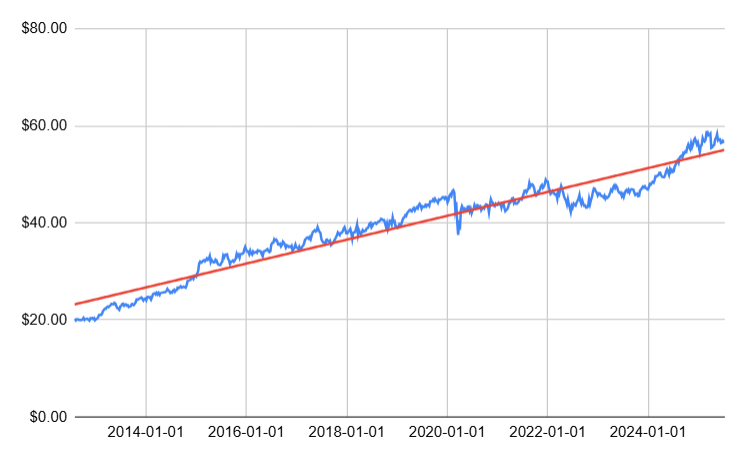

As of July 2025, a linear regression model on 13 years of XMW timeseries data produces an r-squared of 0.93, indicating a strong upward growth trend in this ETF with 93% of its price variations explained simply by the passage of time. Keep in mind however, that past performance does not necessarily guarantee future trends will continue the same way.

As can be seen from the chart, there have been no drastic spikes or drops in price over the long term. Minimum volatility strategies have historically reduced losses during market declines, while still capturing gains in rising markets. By seeking to smooth out the market’s ups and downs, the fund can help you stay invested for the long term.

Disclaimer

The content provided on this blog is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed herein are those of the author(s) and do not reflect the views of any affiliated organizations or institutions.

All investment strategies and investments involve risk of loss. Nothing in this blog should be construed as a recommendation, solicitation, or offer to buy or sell any securities or other financial instruments. You are solely responsible for your investment decisions and should seek the advice of a qualified financial advisor or other professional before making any financial decisions.

The information on this site is provided “as is” without any representations or warranties, express or implied. The author(s) make no representations or warranties in relation to the accuracy, completeness, timeliness, or reliability of any information on this site or found by following any link on this site.

Past performance is not indicative of future results. The author(s) may hold positions in or have other financial interests in securities discussed on this blog.

By using this blog, you agree not to hold the author(s) liable for any losses, damages, or expenses that may arise from reliance on the information provided.