🌱 XAD Key Performance Drivers

Key performance drivers of an ETF targeting U.S. aerospace and defense stocks, especially one with exposure to manufacturers of commercial and military aircraft and defense equipment, typically fall into several major categories. Here’s a breakdown:

1. Government Defense Spending

- Primary Driver: The U.S. government is by far the largest customer for defense contractors.

- Influences:

- Annual defense budget allocations

- Defense contracts and procurement cycles

- Geopolitical tensions

- Increases in international military aid

2. Geopolitical Environment

- Rising conflicts or heightened tensions globally often lead to increased defense spending and higher demand for military equipment and services.

- Key regions of influence:

- Eastern Europe

- Middle East

- Indo-Pacific region

3. Commercial Aviation Recovery and Demand

- Post-COVID travel recovery and rising global demand for air travel drive aircraft orders and deliveries.

- Major Customers: Airlines, cargo operators, leasing firms.

4. Defense Export Demand

- Foreign Military Sales by U.S. government to allied countries.

- International arms sales (e.g., fighter jets, missile systems, surveillance aircraft) often boost revenues for U.S. manufacturers.

5. Technological Innovation and R&D

- Investment in next-gen defense and aerospace tech:

- Hypersonic weapons

- Autonomous systems (UAVs/drones)

- Cyber defense and electronic warfare

- Space-based defense systems (satellites, sensors)

6. Contract Wins and Backlog

- New multiyear contracts (e.g., for fighter jets, satellites, missile systems) are major catalysts.

- Size and stability of order backlogs signal future revenue predictability and investor confidence.

7. Supply Chain and Labor Constraints

- Disruptions in critical components (e.g., semiconductors, titanium, avionics) can delay production and impact margins.

- Skilled labor shortages in manufacturing, engineering, and assembly are particularly relevant in aerospace.

8. Company-Specific Performance

- The ETF’s top holdings will individually influence returns.

- Quarterly earnings, margins, guidance, and cost efficiency matter.

9. Interest Rates and Inflation

- Defense contractors often have long project lifecycles, so:

- Rising interest rates can raise debt servicing costs.

- Inflation impacts input costs (metals, energy, labor).

- Some contracts are cost-plus, providing inflation protection; others are fixed-price and more exposed.

10. Political Climate and Regulation

- Shifts in U.S. administration or Congressional control can affect:

- Defense budget priorities (e.g., focus on traditional vs. cyber defense)

- Regulatory oversight (e.g., ITAR, export controls)

- ESG pressures and investor sentiment on defense stocks

🔍 XAD Risk Assessment

As of Aug 2025, this ETF only has 2 years of history and $71M in assets, and is rated medium-to-high risk by its issuer BlackRock. It can be used strategically to express a U.S. sector view, however may not be suitable for more risk-adverse investors.

Before investing in a newly established ETF with a small amount of assets under management, be aware of key risks such as low liquidity, which can lead to wider bid-ask spreads and higher trading costs, and closure risk, as small ETFs (typically under $100M) may shut down if they don’t attract sufficient investor interest, potentially forcing investors to sell at an unfavorable time.

Additionally, such funds may lack a performance track record, have limited institutional backing, and may not efficiently track their underlying index or strategy due to smaller scale.

1. Concentration Risk

- Sector-specific exposure: Unlike diversified ETFs, this ETF is heavily focused on aerospace and defense. If this sector underperforms, the whole fund may lag the broader market.

- High dependency on a few large players (e.g., Lockheed Martin, Boeing).

2. Geopolitical Risk

- Paradoxically, while geopolitical tension can boost demand, resolution of major conflicts or diplomatic shifts can reduce military spending.

- Sudden policy changes (e.g., U.S. arms export restrictions, defense treaty changes) can impact revenues.

3. Regulatory and Political Risk

- Government defense budgets can be subject to cuts due to:

- Shifts in political leadership (especially in the U.S. Congress or Presidency)

- Deficit control measures

- Public and ESG-driven opposition to defense investments may lead to divestment trends.

4. Commercial Aerospace Cyclicality

- The commercial side of aerospace (e.g., Boeing, GE Aerospace) is cyclical and exposed to:

- Airline profitability

- Oil prices

- Global GDP and travel demand

- Aircraft safety and production issues

5. Operational and Supply Chain Risks

- Aerospace manufacturing is complex, capital intensive, and vulnerable to:

- Delays

- Part shortages (e.g., semiconductors, specialized metals)

- Labor strikes

- Cost overruns in fixed-price defense contracts can hurt margins.

6. Valuation Risk

- Some companies in this ETF may trade at high forward P/E ratios if investor sentiment is strong, making them vulnerable to sharp corrections.

7. Interest Rate and Inflation Sensitivity

- Inflation can pressure profit margins if companies can’t pass on rising costs.

- Rising rates may impact debt-heavy companies and reduce investor appetite for equities in general.

✅ Suitable For:

- Sector-specific investors

Seeking targeted exposure to the aerospace and defense industry as a thematic investment. - Investors hedging geopolitical risk

Those who believe global tensions and military spending will remain elevated, benefiting the defense sector. - Portfolio diversifiers

Looking to reduce exposure to tech or finance-heavy portfolios by adding industrial/defense equities.

❌ Not Suitable For:

- ESG or ethical investors

Concerned about exposure to weapons manufacturing, military contracts, or companies that conflict with socially responsible principles. - Low risk tolerance investors

Uncomfortable with volatility due to sector concentration, government dependency, and global conflict exposure. - Those seeking broad diversification

This ETF is concentrated in a niche sector and lacks exposure to other industries or international markets.

🧭 XAD Trend Analysis

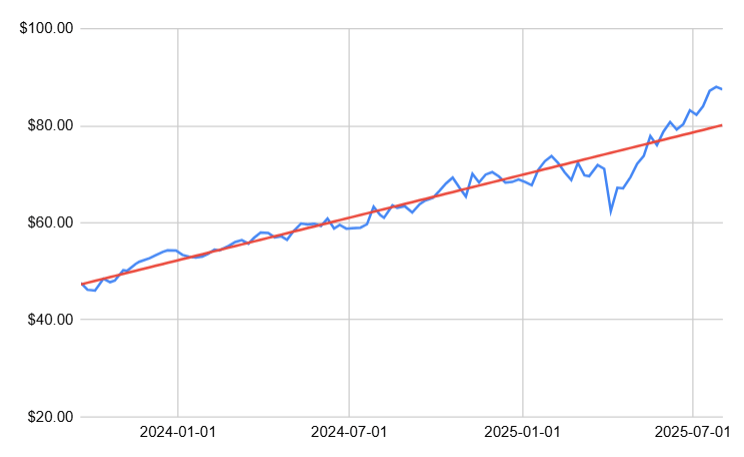

As of Aug 2025, a linear regression model on 2 years of XAD timeseries data produces an r-squared of 0.92, indicating a strong upward growth trend in this ETF, with 92% of its price variations explained simply by the passage of time. Keep in mind however, that there is only 2 years of data so far, and that past performance does not necessarily guarantee future trends will continue the same way.

Since inception in Sep 2023, XAD has grown an impressive average of 44.82% a year, currently at 8.37% above its linear regression line.

📈 Key Drivers of XAD’s Growth Trend from Sep 2023 to Aug 2025

1. Robust Defense and Aerospace Spending

- As global geopolitical tensions intensified—from Eastern Europe to the Indo-Pacific region—U.S. defense spending held steady or grew, bolstering revenues for top contractors like RTX, General Dynamics, Lockheed Martin, Northrop Grumman, and GE Aerospace, which are the ETF’s largest holdings(Yahoo Finance, BlackRock).

2. Favorable Commercial Aviation Recovery

- The rebound in global air travel post‑pandemic lifted demand for new commercial aircraft. GE Aerospace and Boeing, both prominent in XAD’s portfolio (~18–19% and ~9% respectively), benefited from rising aircraft orders and deliveries(Yahoo Finance, Yahoo Finance).

3. Index-Based Allocation with Concentrated Leaders

- XAD tracks the Dow Jones U.S. Select Aerospace & Defense Index and uses full replication. Its top 10 holdings account for ~75% of the fund, giving large-cap industry leaders outsized weight and reinforcing performance during their rallies(Valueray).

4. Low Competition and Canadian Dollar Tailwinds

- As the only ETF in CAD on the Toronto Stock Exchange that provides pure U.S. aerospace & defense exposure (listed Sept 2023), it drew inflows from Canadian investors seeking defense exposure without FX conversion—supporting assets under management growth ~C$46–68 m through strong net inflows (~C$36 m in first year)(TipRanks, ycharts.com, BlackRock).

- Positive CAD/USD trends have also boosted CAD‑denominated returns.

5. Relative Resilience Amid Broader Market Volatility

- During broader market downturns and rate vol cycles, aerospace & defense securities often show defensive characteristics. Reddit commentary indicates that while broader markets fell in 2020–22, aerospace & defense held up much better, showing limited price declines compared to broader indices(Yahoo Finance).

Disclaimer

The content provided on this blog is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed herein are those of the author(s) and do not reflect the views of any affiliated organizations or institutions.

All investment strategies and investments involve risk of loss. Nothing in this blog should be construed as a recommendation, solicitation, or offer to buy or sell any securities or other financial instruments. You are solely responsible for your investment decisions and should seek the advice of a qualified financial advisor or other professional before making any financial decisions.

The information on this site is provided “as is” without any representations or warranties, express or implied. The author(s) make no representations or warranties in relation to the accuracy, completeness, timeliness, or reliability of any information on this site or found by following any link on this site.

Past performance is not indicative of future results. The author(s) may hold positions in or have other financial interests in securities discussed on this blog.

By using this blog, you agree not to hold the author(s) liable for any losses, damages, or expenses that may arise from reliance on the information provided.